The simple answer is “Yes.”

After filing Chapter 7, you can buy anything you want.

The real question is, “Can I get a mortgage?”

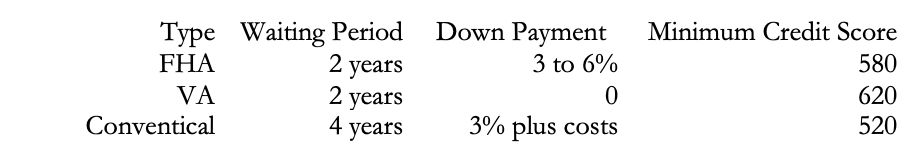

To initially qualify for a mortgage, you must wait.

(The above starts from the discharge date, not the filing date.)

The higher your credit score; the more of a downpayment; and the more time since Chapter 7, the better!

The above is the simplified requirements.

Lenders expect a “clean” record for the preceding two years.

Lenders want a letter explaining what led you to Bankruptcy with evidence to back it up.

When should I file?

When it is evident that filing Chapter 7 bankruptcy is your best strategy, the sooner, the better.

Why?

- The lapse of time. If you file now, you wait two years for the FHA or VA loan. If you wait until next year, the waiting period is three years from now.

- When filing Chapter 7, any money you earn, you keep.

- Once you file, you can put money in your pocket. You can begin saving for the future. The money currently spent on debts can go into a saving account. Figure out how much you spend every month on these debts. Then multiply it by 24. If $200 monthly now, you can have a next egg of approximately $5,000 in two years. If $400 monthly, the number is approximately $10,000 in the bank.

- Removal of stress. Right now, you may be juggling whom to pay first. You may have collection letters and calls. There may be threats of lawsuits and Wage Garnishments. You will feel better.

I can’t tell how often I have heard this from clients: “Why did I wait so long?” “I feel like a load has been lifted off my shoulders.”

I have many former Chapter 7 clients who are now proud homeowners.

If you are buried in debt and have ambitions to become a homeowner, don’t be afraid to file for Chapter 7 bankruptcy. Do it now!