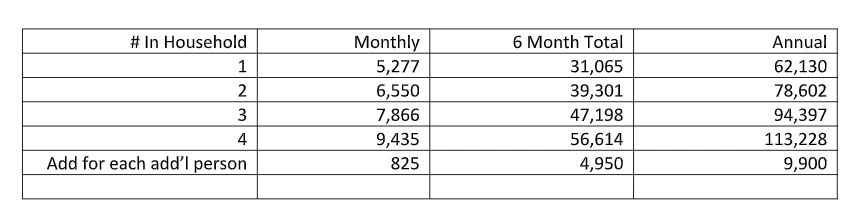

Bankruptcy laws say you must do a Means Test. You must list the gross income in your family for the past six (6) months. Is the total amount below or above the amounts listed in the table below?

The number of persons in the household is generally the number on your tax return. But you can include the following:

- Children away at college.

- Relatives living with you like parents, grandchildren, and nieces and nephews.

- Significant others, including their children.

- Anyone living with you who are dependent on you.

You must include all the household income and deduct the bills for the whole family.

The Means Test does not include Social Security benefits.

The Means Test does not include Child tax credits.

Source Census Bureau Median Family Income by Family Size as of November 1,2022.

Most people have income below the Means Test.

What if your gross income is over the amounts listed below? The law intends to deter you from filing Chapter 7. But frequently, we can defeat the Means Test.

Experienced and skilled lawyers understand the test. Our law firm has successfully defeated the Means Test. Several of our clients whose income is above the threshold still filed Chapter 7.

What if you can’t file Chapter 7 because of the family income? There are ways of keeping the Chapter 13 dividend as low as possible.

Many of our clients who must file Chapter 13 pay a small dividend to unsecured creditors. Like 10% or so.

Suppose your income is above the Means Test. There are many deductions that may allow you to file Chapter 7. Or file a low dividend in Chapter 13. To name a few:

- IRS allowances for housing, food, clothing, and transportation.

- Federal and state taxes; social security and Medicare deductions.

- Court-ordered deductions that will continue, such as Child support.

- Childcare and deductible tuition and school expenses for children under the age of 18.

- Mandatory retirement plans, union dues and uniforms.

- Secured debt payments such as Mortgage payments and car loans. Also, real estate taxes and homeowner’s insurance if you have a non-escrowed mortgage.

- Out-of-pocket health care; Health Insurance premiumsfor you and your dependents. Also, term life insurance and disability insurance.

- Charitable Contributions such as contributions to your church up to 15% of your gross income.

- Continued contributions to elderly, chronically ill or disabled family members. And they don’t have to live with you.

- Taxes that can’t be discharged in Chapter 7.

- TheMeans Test allows deductions for the non-filing spouse’s expenses if only one spouse files a case.

Some other points to consider:

Separated spouses can but file together. There will be 2 Means Tests: one for each spouse.

What about overtime premiums and periodic bonuses? It is income. But, if overtime premiums or bonuses have stopped, we can work around it. If a bonus is once a year, it can amortize. Same if overtime is for one part of the year.

For most people, the above is a lot of legalese. To a skilled and experienced lawyer, it lays the foundation to beat the Means Test. We frequently help clients defeat the Means Test.

Chapter 13. The Means Test form is a bit different, and it dictates how big your payments will be. If your income exceeds the National Standards, the plan must run for five (5) years. But, still, many of our clients pay a small dividend to unsecured creditors.

Disclaimer: Blogs on legal matters are for information purposes only and is not to be construed as legal advice.

For more information on THE MEANS TEST, call our office today.